Featured

Gst On Imported Goods Under $1000

Gst On Imported Goods Under $1000. Qualifying for gst as an overseas business claimant overseas businesses need to meet certain requirements before qualifying to claim gst.; This ‘rule of thumb’ does not apply to items that attract both duty.

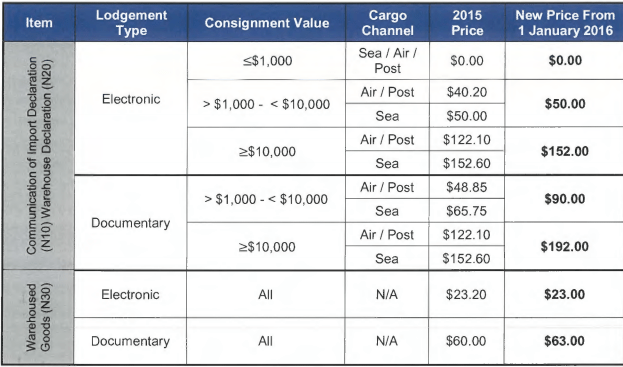

The perceived preferential treatment of internet shopping has been a contentious issue for a while with the retail sector lobbying hard to ensure that where a business is benefiting. There is a $1,000 customs threshold and generally speaking, customs does not collect gst or duty on imported goods valued at or below this amount. The existing processes to collect gst on imports over a.

Currently, Imports Below $1,000 Are Excluded From Gst.

The perceived preferential treatment of internet shopping has been a contentious issue for a while with the retail sector lobbying hard to ensure that… Gst on low value imported goods. Australian law requires that all goods are assessed for customs duties, goods and services tax (gst) and possibly other taxes, and for quarantine risks.

The $1,000 Customs Threshold Does Not Apply To Tobacco Or Alcohol Products.

The government wants to extend gst to imported online goods under a$1000, effective from 1 july 2017, with treasurer scott morrison stating it will “establish a level playing field for our domestic retailers”. The customs value is the price the goods are sold for, minus freight and insurance from the place of export. The intent is that low value goods imported by consumers will face the same tax regime as

From 1 July 2018, Your Online Shopping May Cost You 10% More.

While the start date of the change has been pushed back until 1 july 2018, businesses importing goods into australia will need to review their position to check whether supply chains are. This ‘rule of thumb’ does not apply to items that attract both duty. However, gst can still apply to the sale of these goods by an overseas seller to an australian consumer.

My Understanding Is If Goods Are Under 1000 No Gst, Over 1000 Then Gst Is Calculated Based On Value.

Instead, gst will be collected through suppliers, electronic distribution platforms or goods forwarders under the existing registration system or a simplified system. The buyer must pay 10% gst on the value of the taxable import which includes the goods themselves, inwards freight, insurance. Who needs to charge gst merchants selling directly and online, online.

The Current $1,000 Gst, Duty And Reporting Import Threshold Will Not Be Changed Or Lowered.

The perceived preferential treatment of internet shopping has been a contentious issue for a while with the retail sector lobbying hard to ensure that where a business is benefiting. The gst is actually paid by the buyer rather than the supplier, also known as a 'reverse charge'. You’re likely to be paying gst on imported items under $1000 from the start of december.

Popular Posts

I Ve Been Looking Under Rocks And Breaking Locks

- Get link

- X

- Other Apps

Comments

Post a Comment